All Categories

Featured

Table of Contents

- – Preferred Accredited Investor Opportunities wi...

- – Most Affordable Accredited Investor Platforms

- – Preferred Accredited Investor Platforms

- – Strategic Accredited Investor Real Estate Dea...

- – Premium Accredited Investor Property Investm...

- – Preferred Accredited Investor Passive Income...

- – High-End Exclusive Investment Platforms For ...

The laws for certified investors differ amongst territories. In the U.S, the interpretation of a recognized financier is placed forth by the SEC in Guideline 501 of Regulation D. To be a recognized financier, an individual has to have an annual earnings going beyond $200,000 ($300,000 for joint earnings) for the last two years with the expectation of making the very same or a greater earnings in the existing year.

This quantity can not consist of a main residence., executive police officers, or directors of a company that is releasing unregistered safety and securities.

Preferred Accredited Investor Opportunities with Accredited Investor Returns

If an entity is composed of equity proprietors who are recognized investors, the entity itself is a certified financier. Nonetheless, a company can not be created with the single function of purchasing certain safeties - Accredited Investor Opportunities. A person can certify as a recognized financier by showing adequate education and learning or work experience in the economic market

People that wish to be recognized financiers do not relate to the SEC for the designation. Rather, it is the duty of the business offering an exclusive positioning to make certain that every one of those approached are accredited investors. Individuals or parties that want to be approved investors can approach the company of the unregistered securities.

As an example, suppose there is a private whose earnings was $150,000 for the last three years. They reported a primary home value of $1 million (with a home loan of $200,000), a cars and truck worth $100,000 (with an exceptional loan of $50,000), a 401(k) account with $500,000, and a savings account with $450,000.

Total assets is determined as properties minus liabilities. This individual's internet well worth is exactly $1 million. This entails an estimation of their possessions (other than their primary home) of $1,050,000 ($100,000 + $500,000 + $450,000) less an auto loan equating to $50,000. Because they meet the net well worth need, they certify to be an accredited investor.

Most Affordable Accredited Investor Platforms

There are a couple of less common qualifications, such as taking care of a trust with greater than $5 million in possessions. Under federal securities regulations, only those who are certified financiers might get involved in particular safety and securities offerings. These may include shares in private positionings, structured products, and private equity or bush funds, among others.

The regulatory authorities wish to be certain that individuals in these very risky and complex investments can fend for themselves and evaluate the dangers in the absence of federal government defense. The recognized financier policies are developed to shield possible capitalists with restricted economic knowledge from adventures and losses they might be unwell geared up to stand up to.

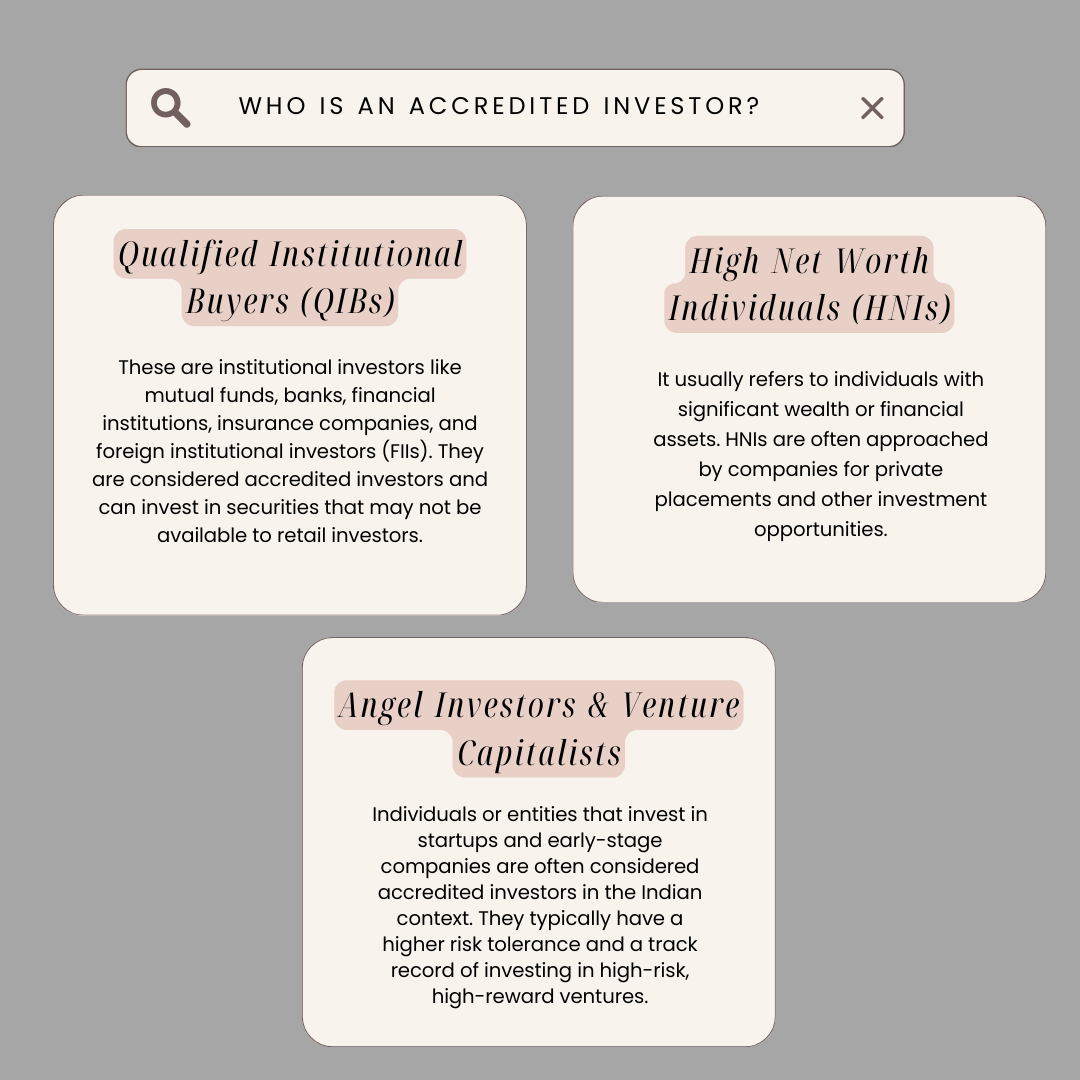

Accredited investors fulfill qualifications and expert standards to gain access to exclusive financial investment possibilities. Certified capitalists must meet earnings and internet well worth demands, unlike non-accredited people, and can spend without limitations.

Preferred Accredited Investor Platforms

Some key changes made in 2020 by the SEC consist of:. This adjustment identifies that these entity types are usually used for making investments.

This modification make up the effects of rising cost of living with time. These amendments increase the certified financier swimming pool by roughly 64 million Americans. This broader access offers more possibilities for investors, yet additionally raises possible risks as much less monetarily sophisticated, investors can participate. Businesses using private offerings might profit from a larger swimming pool of possible capitalists.

One significant benefit is the possibility to spend in positionings and hedge funds. These investment alternatives are unique to accredited capitalists and establishments that qualify as a recognized, per SEC policies. Exclusive positionings allow business to secure funds without navigating the IPO treatment and regulatory paperwork needed for offerings. This provides accredited investors the possibility to spend in arising business at a stage prior to they consider going public.

Strategic Accredited Investor Real Estate Deals for Financial Growth

They are watched as investments and come only, to qualified customers. Along with recognized business, certified investors can choose to spend in startups and promising endeavors. This provides them tax obligation returns and the opportunity to enter at an earlier stage and potentially enjoy incentives if the company flourishes.

Nonetheless, for investors available to the dangers included, backing start-ups can lead to gains. Most of today's tech business such as Facebook, Uber and Airbnb came from as early-stage startups supported by approved angel financiers. Innovative capitalists have the chance to check out financial investment alternatives that might yield a lot more earnings than what public markets offer

Premium Accredited Investor Property Investment Deals for Wealth-Building Solutions

Returns are not guaranteed, diversification and profile enhancement choices are broadened for investors. By expanding their portfolios with these expanded investment opportunities certified investors can enhance their approaches and possibly achieve remarkable lasting returns with appropriate risk monitoring. Seasoned capitalists usually come across financial investment options that might not be quickly available to the basic investor.

Investment alternatives and safety and securities offered to approved capitalists normally entail higher dangers. Personal equity, venture funding and hedge funds frequently focus on spending in assets that bring risk but can be sold off conveniently for the opportunity of greater returns on those dangerous investments. Looking into prior to spending is essential these in situations.

Lock up periods avoid financiers from withdrawing funds for more months and years on end. Investors might struggle to accurately value personal possessions.

Preferred Accredited Investor Passive Income Programs with Accredited Investor Returns

This adjustment may prolong recognized investor condition to a series of individuals. Updating the income and property benchmarks for rising cost of living to guarantee they mirror changes as time progresses. The present thresholds have remained static given that 1982. Permitting partners in dedicated relationships to integrate their resources for shared eligibility as certified investors.

Making it possible for people with certain professional accreditations, such as Collection 7 or CFA, to qualify as recognized financiers. Developing extra demands such as evidence of financial literacy or effectively completing an accredited capitalist examination.

On the other hand, it might additionally result in knowledgeable financiers thinking extreme risks that might not be ideal for them. Existing recognized investors might face raised competition for the finest investment chances if the swimming pool expands.

High-End Exclusive Investment Platforms For Accredited Investors

Those who are presently thought about certified financiers have to remain upgraded on any alterations to the requirements and policies. Organizations seeking certified financiers should stay attentive about these updates to guarantee they are drawing in the best target market of investors.

Table of Contents

- – Preferred Accredited Investor Opportunities wi...

- – Most Affordable Accredited Investor Platforms

- – Preferred Accredited Investor Platforms

- – Strategic Accredited Investor Real Estate Dea...

- – Premium Accredited Investor Property Investm...

- – Preferred Accredited Investor Passive Income...

- – High-End Exclusive Investment Platforms For ...

Latest Posts

Is Buying Tax Lien Certificates A Good Investment

Investing In Tax Liens And Deeds

Tax Lien Investing Illinois

More

Latest Posts

Is Buying Tax Lien Certificates A Good Investment

Investing In Tax Liens And Deeds

Tax Lien Investing Illinois